What is the Federal Tax Incentive?

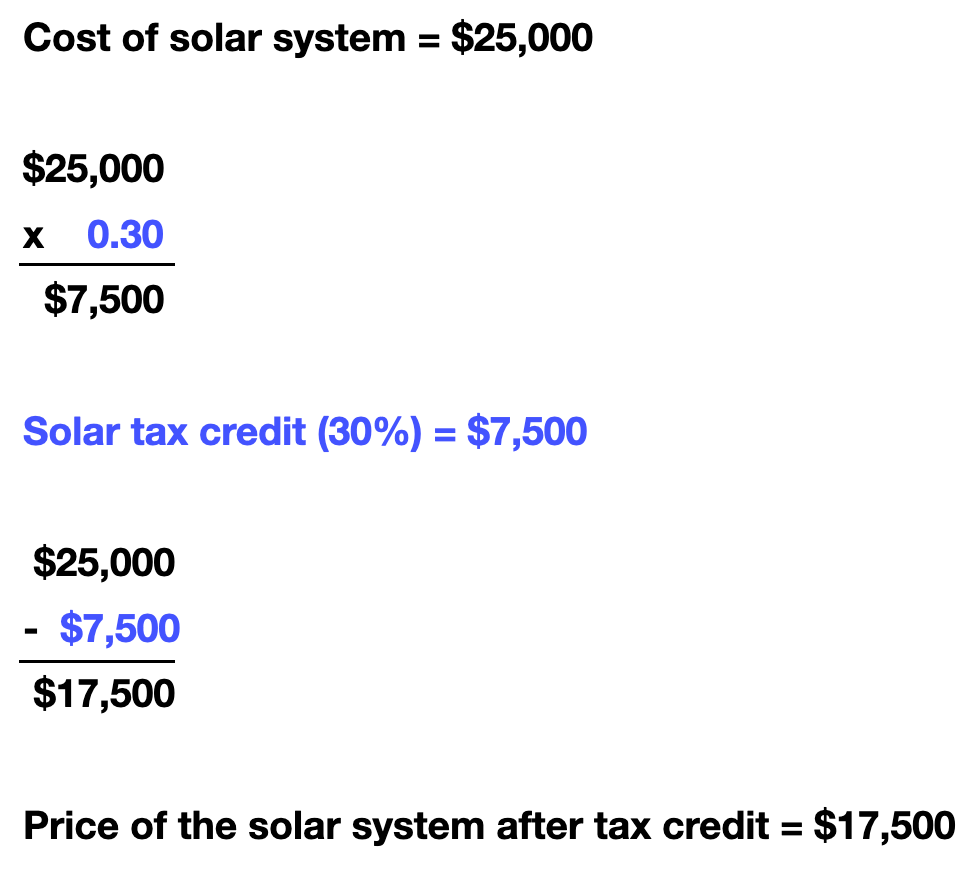

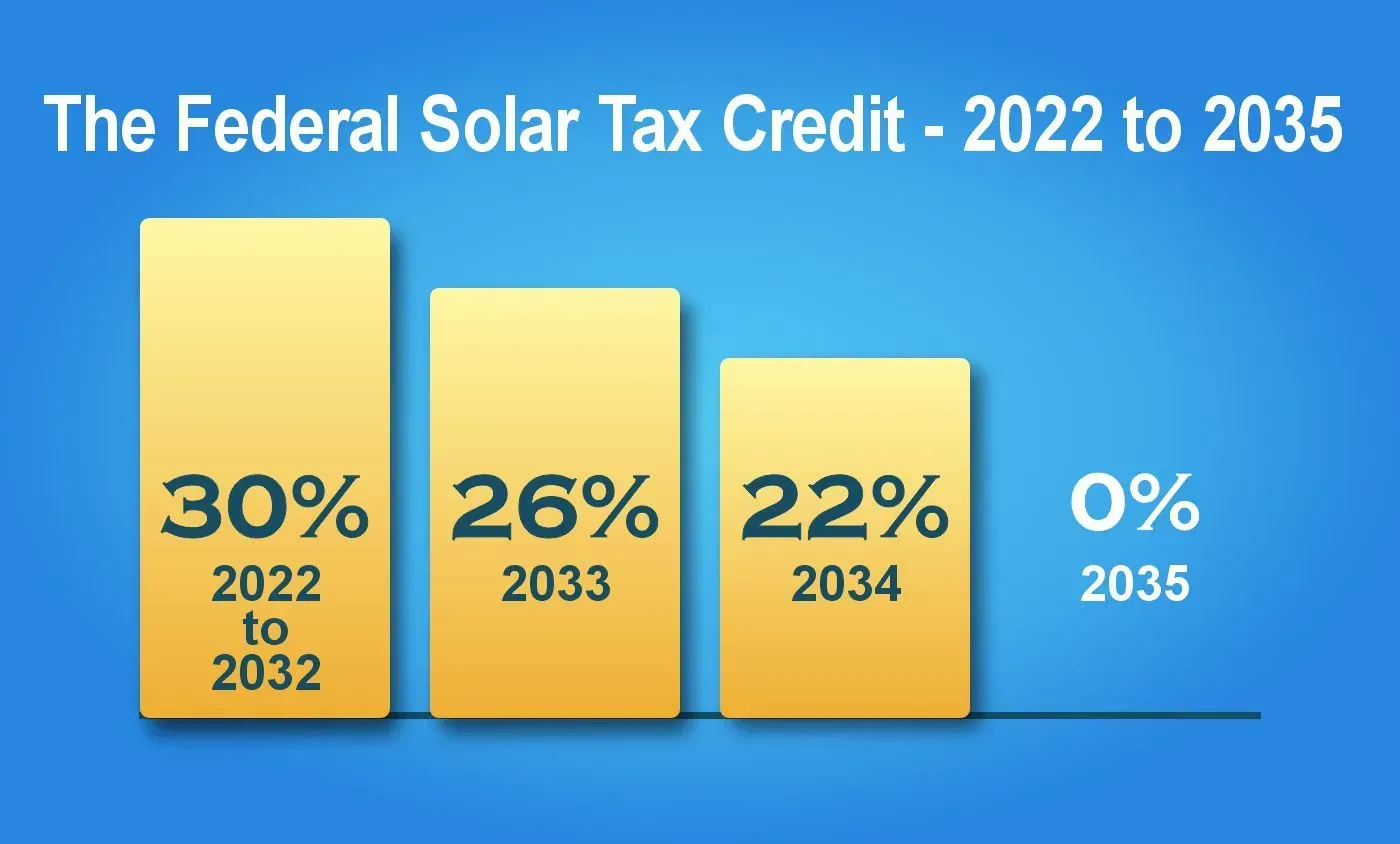

The Solar Tax Credit, also known as the Investment Tax Credit (ITC), is a federal program that allows homeowners and businesses to deduct a percentage of the cost of installing solar energy systems from their federal taxes. As of 2024, the credit is 30% of the installation cost.

The government offers this incentive to encourage the adoption of renewable energy, reduce reliance on fossil fuels, and combat climate change. By making solar installations more affordable, the tax credit aims to accelerate the transition to cleaner energy sources, reduce greenhouse gas emissions, and promote sustainable energy solutions across the country

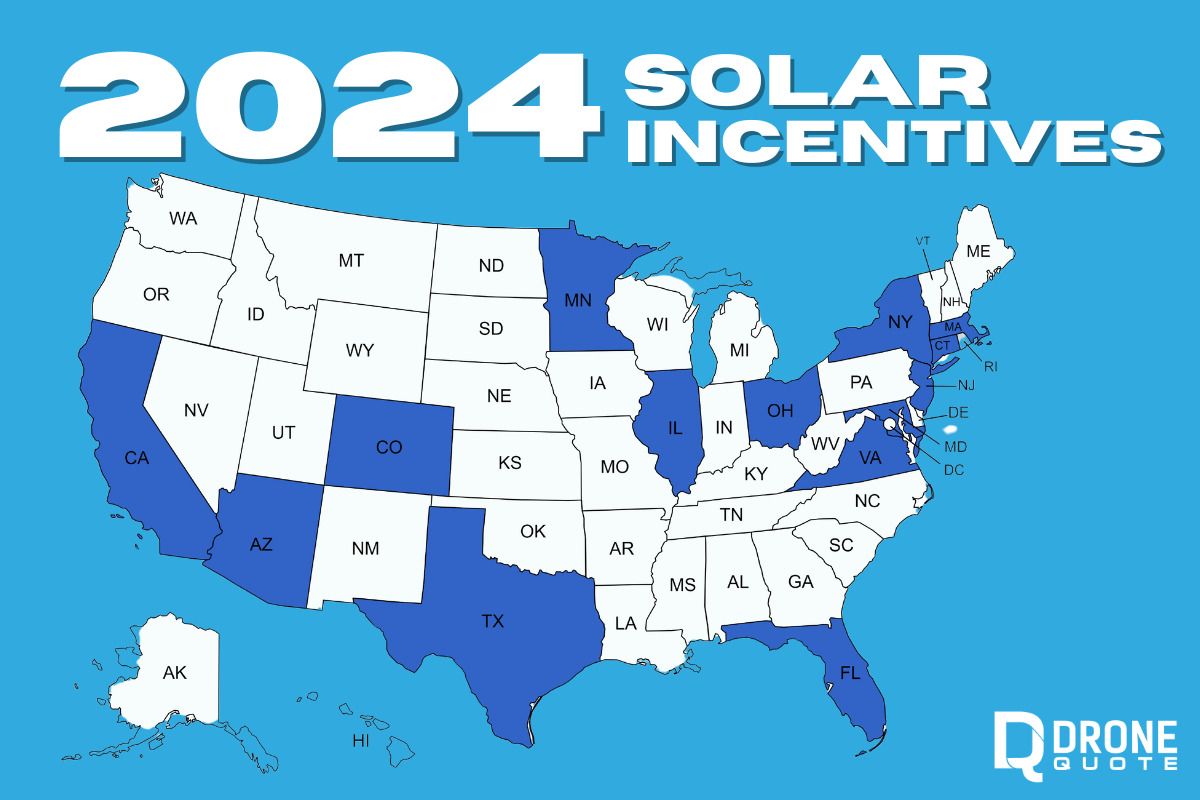

What Are My State Incentives?

Pennslyvannia Solar Incentives

Net Metering: Allows solar energy producers to receive credits for excess power sent back to the grid.

Property Tax Exemption: Exempts solar systems from local property taxes.

Sales Tax Exemption: Exempts solar equipment from state sales tax.

Federal Solar Tax Credit: Federal incentive offering 30% tax credit on solar system installation costs.

Solar Energy Program (State Grant): Grants for solar energy systems for businesses and municipalities.

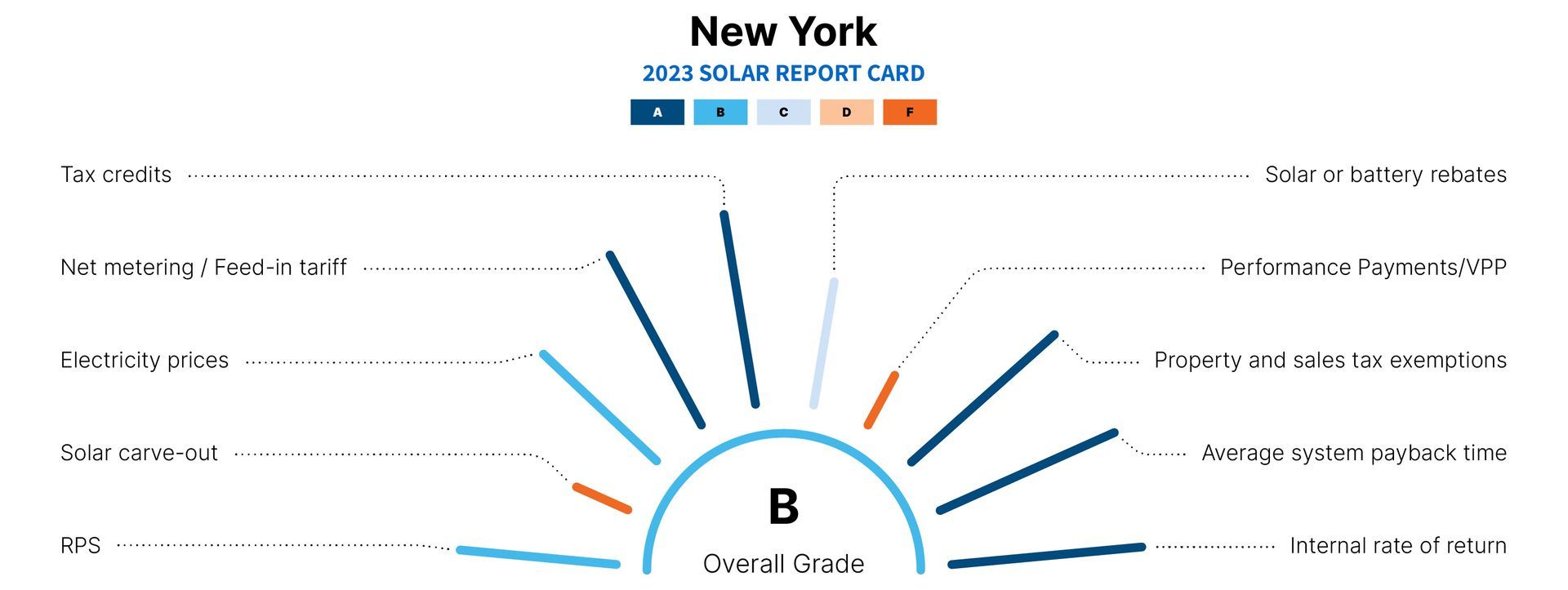

New York Solar Incentives

New York State Solar Tax Credit: State tax credit offering up to 25% of installation costs (up to $5,000).

NY-Sun Incentive Program: Cash incentives for residential and commercial solar installations (varies by system size).

Net Metering: Allows solar owners to receive credits for excess power sent to the grid.

Property Tax Exemption: Exempts solar energy systems from local property taxes.

Sales Tax Exemption: Exempts solar equipment from state sales tax.

Federal Solar Tax Credit: 30% federal tax credit on solar installation costs.

Ohio Solar Incentives

Ohio Solar Tax Credit: Offers a 30% tax credit for solar system installation (up to $25,000).

Net Metering: Allows solar owners to receive credits for excess power sent to the grid.

Property Tax Exemption: Exempts solar energy systems from local property taxes.

Sales Tax Exemption: Exempts solar equipment from state sales tax.

Federal Solar Tax Credit: 30% federal tax credit on solar system installation costs.